KARACHI:

While the continuation of the 0.25% income tax facility for the Information Technology (IT) sector – as it is now categorised as Small and Medium Enterprises (SMEs) – until June 30, 2026, is seen as a positive step, IT sector experts are expressing their disappointment with the budget, stating that the government has failed to meet their demands aimed at further boosting the industry.

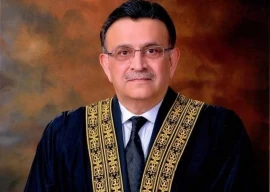

In his budget speech for the fiscal year 2023-24, Finance Minister Ishaq Dar acknowledged the significant role of the IT and IT Enabled Services (ITeS) sectors in Pakistan’s economic growth. Despite challenges posed by the global economy, the minister expressed confidence in the sector’s potential to be the engine of growth in the coming years.

While the government claims that Pakistan ranks second globally in terms of freelancers contributing to its business, industry experts highlight the fluctuating nature of this statistic across different platforms and timeframes. Nevertheless, the government emphasised the importance of the IT sector by extending the 0.25% income tax facility until June 30, 2026.

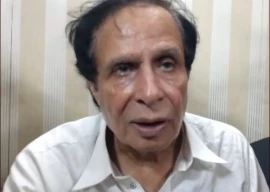

However, speaking to The Express Tribune, Pakistan Software Houses Association ([email protected]), Chairman, Muhammad Zohaib Khan expressed his dismay, questioning the effectiveness of the tax facility by pointing out the drop in IT exports this year.

To address some of the challenges faced by freelancers, the government announced exemptions from sales tax registration and filing for freelancers earning up to $24,000 annually. Simplified tax return forms will be issued to facilitate their business environment.

The budget also includes provisions to support the IT sector, such as allowing tax-free imports of hardware and software equivalent to 1% of their exports, as well as the establishment of a Venture Capital Fund with a budget allocation of Rs5 billion to provide entrepreneurial capital.

While the categorisation of the IT sector as Small and Medium Enterprises (SMEs) is expected to benefit from concessional income tax rates, experts note that the industry still faces challenges due to high inflation and other market barriers resulting from political instability. The industry believes that more initiatives are needed to boost the IT sector and address the cost of doing business in Pakistan.

The IT industry is rapidly growing in Pakistan, with its share in exports also increasing, according to Irfan Iqbal Sheikh, President of FPCCI. The sector’s inclusion as SMEs in the budget is expected to drive IT development and boost exports. “The budget is overall positive for the IT sector because there were speculations about the government imposing income tax on IT exports in line with local sales. However, the government maintained the 0.25% tax rate, which is a relief for IT exporters,” said ICT analyst Nasheed Malik from Topline.

The government’s commitment to incentivising the technology sector reflects its potential to contribute to the country’s economy through increased export earnings, according to ICT analyst Waqas Ghani Kukaswadia from JS Global.

However, [email protected] chairman expressed disagreement with the aforementioned analyst, stating that the government did not address the demands necessary for IT export growth.

The previous government, led by Shahid Khaqan Abbasi, had granted a 100% tax exemption, which was later withdrawn by the current government. Long-term policies with consistency and execution are needed to support the IT industry, as uncertainties remain about the continuity of the government’s commitments, said the [email protected] chairman.

The IT and ITeS providers had requested permission to keep 100% foreign currency accounts and transfer dollars abroad. They often need to travel overseas to meet clients, requiring dollars for marketing, branding, and product exhibitions. Allowing IT exporters to retain 100% dollars in their accounts would ultimately benefit the country, as businesses tend to invest where they can retain funds, emphasised Khan.

Export declines can be attributed to government policies and a lack of understanding of the dynamics of the IT export market among decision-makers in power corridors, he said. To revitalise the country’s dwindling economy, the government must support the IT sector and leverage its vast potential.

Published in The Express Tribune, June 10th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ