ISLAMABAD:

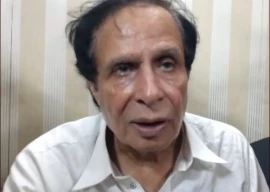

A local court in Islamabad on Tuesday granted bail to Pakistan Tehreek-e-Insaf (PTI) Vice Chairman Shah Mahmood Qureshi in a case registered against him over attacks on sensitive state installations following May 9.

After the PTI chief was arrested on corruption charges last month, miscreants vandalised key military and state sites. This was followed by a crackdown on the PTI leadership, resulting in Qureshi's own arrest under Section 3 of the Maintenance of Public Order Act (3MPO).

After remaining in custody for roughly a month, Qureshi was released from Adiala Jail last week.

Read NA backs military trial of May 9 rioters

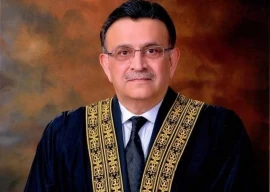

Today, Additional Sessions Judge Syed Haroon Ahmed heard the PTI leader's bail plea in a related case.

Qureshi's lawyer, Ali Bukhari, requested the district and sessions court to grant him bail. The judge approved the request against a bond of Rs10,000 and granted him bail until July 4.

After the hearing, Qureshi told journalists the case was "baseless". "Two cases were registered against me in connection with May 9," he said, "but I was not even present in Islamabad. I was in Karachi at the time."

'Default risk mounting'

While speaking with journalists outside the district and sessions court after the hearing, Qureshi expressed serious reservations over the budget presented by the federal government.

"There is a lot of debate surrounding the budget," he noted before claiming that "even the [government's] experts are not on the same page about it".

"The presented budget clearly violates the conditions given by the International Monetary Fund (IMF)," he said. "The country is heading towards a default."

Notably, Pakistan has requested China to fast-track the refinancing of maturing commercial loans of $1.3 billion and apprised it of the diminishing prospects of revival of the IMF loan programme.

The request was made by Finance Minister Ishaq Dar during a meeting with China’s Charge d’affaires Pang Chunxue at the Finance Division.

Government officials said that the finance minister raised the issue of refinancing the two Chinese commercial loans amounting to $1.3 billion. The loans are maturing in the next two to three weeks.

Chinese authorities have already assured Pakistan that they will refund both the loans but Islamabad wants the money to be re-lent as soon as it is paid back, according to sources.

Read More Economist sees imminent default without IMF

Dar is said to have urged the Chinese charge d’affaires about timely refinancing the loans, which will prop up Pakistan’s foreign exchange reserves.

Pakistan is scheduled to make a debt repayment of $300 million to the Bank of China in less than two weeks and repay another $1 billion to China Development Bank within three weeks.

The country’s official foreign exchange reserves stand at $3.9 billion and any delay in refinancing the loans could pull the reserves much below $3 billion.

“The finance minister further updated the charge d’affaires about progress on talks with the IMF on completion of the ninth review,” said a statement issued by the Ministry of Finance.

Dar said that the IMF was not accepting Pakistan’s request to lower the requirement of arranging $6 billion in new loans despite a marked reduction in the current account deficit, according to the officials. Pakistan had arranged $4 billion but the IMF was still insisting on $6 billion in fresh loans, he added.

At a public gathering yesterday, Dar had pointed out that Saudi Arabia had pledged $2 billion and the United Arab Emirates $1 billion to help Pakistan reach a staff-level agreement.

He said that there was hope that after arranging $3 billion the IMF would sign the staff-level agreement but that did not happen. “After the agreement, there is hope that the World Bank will approve $450 million and the Asian Infrastructure Investment Bank will give $250 million.”

However, budget books showed that the government did not expect the $3 billion to come before June 30 and included the inflows in the next fiscal year’s estimates.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ